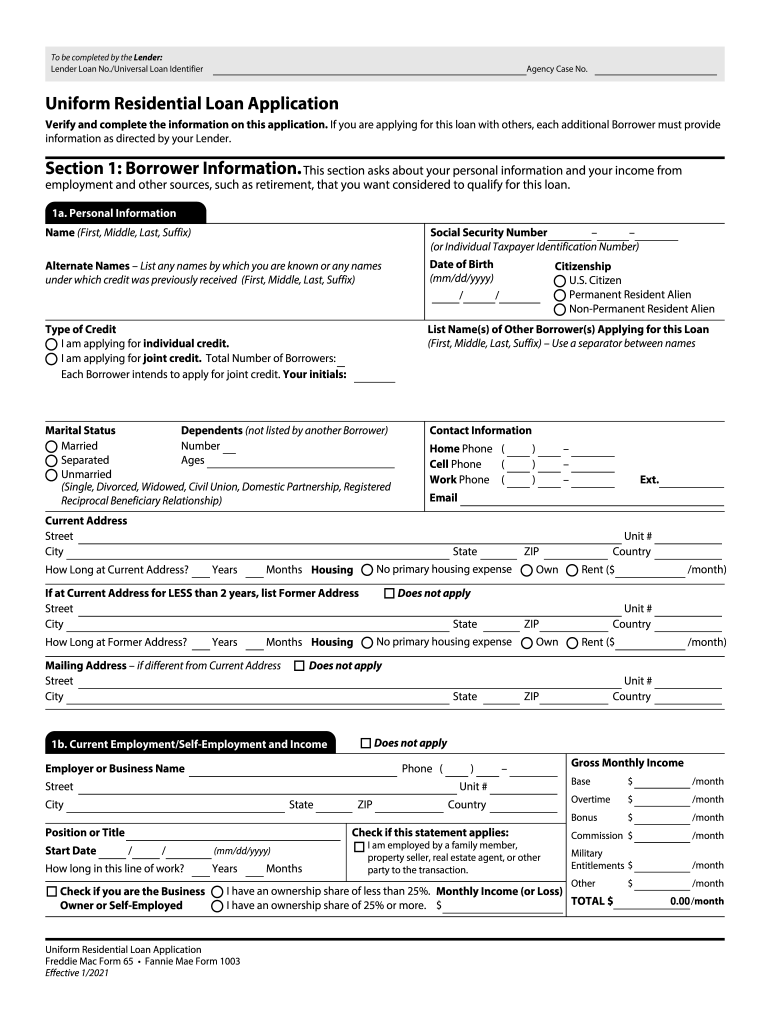

What is Uniform Residential Loan Application?

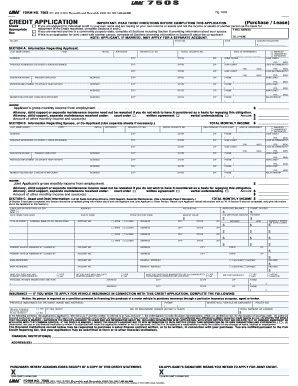

The Uniform Residential Loan Application is a form used to be filled out by borrower or co-borrower, who are applicants, with the lender’s assistance when making a request for a credit.

What is Uniform Residential Loan Application for?

The Form is designed to apply for a loan from the lender and provide all necessary information on the borrower or co-borrower that will serve as a loan qualification, or both borrower and co-borrower, if they apply for a joint credit.

When is Uniform Residential Loan Application Due?

The Uniform Residential Loan Application doesn’t have any deadlines or due dates. It is completed and signed when the lender and the borrower decide to officially approve the fact of the applying for a loan.

Is Uniform Residential Loan Application Accompanied by Other Forms?

The Form is not accompanied by any other forms. You should check with the lender, in case if there are additional documents required.

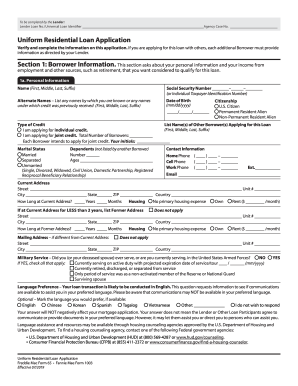

What Information should I Include in Uniform Residential Loan Application?

The Uniform Residential Loan Application consists of eight sections that should include type of mortgage and terms of loan, property information and purpose of loan, borrower’s information, information on borrower’s employment, information on borrower’s income and expenses, assets and liabilities, details of transactions, declarations. The ninth section is acknowledgement and agreement, where borrower or co-borrower, or both have to put dates and signatures. The last section is for government monitoring. There is also continuation sheet if you have to include more information in the application.

Where do I Send Uniform Residential Loan Application?

Upon completion, the Form is sent to the lender. You should check the terms and address where to send the application with the lender.